Look up on Google Play! It's a Rip off! It's a Scam! It's a Super Shenanigan!

The Android ecosystem never fails to present new and fascinating get-rich-schemes.

Just came across an app developer called PLATDI Studio (not bothering to provide a link, I don’t expect them to be around for long). They currently have four apps on Play, titled:

- Voice Changer App: Sound Effects, Voice Modifier

- Voice recorder app : Audio editor - Best recorder

- Screen recorder: display recorder, smart recorder

- Image converter: Convert image format easily

Yep, that’s an awful lot of keywords right there, they sure did their ASO homework and, according to my trustworthy apk downloader, bought 3750 fake 5-star ratings for their voice changer app:

aggregateRating {

type: 2

starRating: 4.2130437

ratingsCount: 5074

oneStarRatings: 683

twoStarRatings: 198

threeStarRatings: 220

fourStarRatings: 220

fiveStarRatings: 3750

commentCount: 2125

}

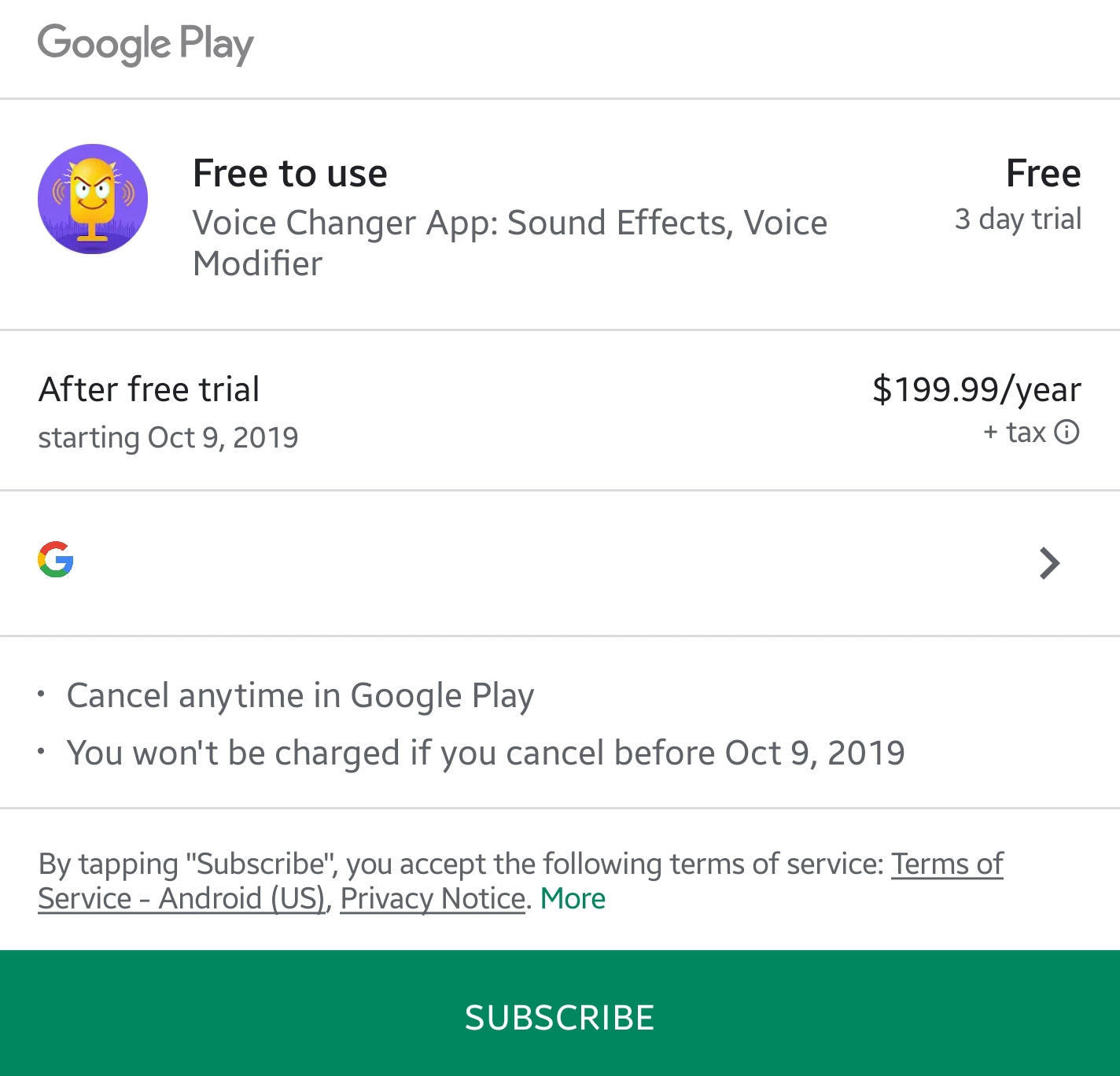

How do I know those 5 star ratings are fake? Because the app was uploaded 2 weeks ago, has 100k+ downloads, all the good reviews sound pretty generic (“great!”, “good app”,…) and the bad ones consistently complain about a very specific issue: directly after starting the app, it asks for a credit card number and only afterwards, you are given a free 3 days trial. In case you forget to cancel, the trial turns into a $200 per year subscription. All four apps have the same build, but only the two voice apps currently seem to have large scale ad campaigns running, bringing in unsuspecting users.

A trial turning automatically turning into a subscription is perfectly legal!

The pricetag of $200/year seems steep at first, but let’s keep in mind that this is an annual fee and a lot of people are perfectly fine spending $17/month on IAPs that give them nothing but virtual bling. Factor in the cost of software development (no, apps aren’t build as weekend project. It actually does take months of hard work) and you can’t even call this a rip off as long as the app performs as promised.

Legally, this developer is in the clear. Yet, it feels so wrong. But why? Where’s the bone of contention? What kind of a shenanigan is this?

What most people don’t know about credit card payment.

Being tricked into a $200 payment is something that won’t sit well with most people. Luckily, the credit card system is so utterly ill designed (knowing a number that can’t be kept secret is all that’s needed to make a charge for an arbitrary sum) that credit card companies had to build in an easy “money- back-in-case-of-unauthorized-use” guarantee to convince consumers to use their product at all. For a merchant, such a chargeback is a nightmare, though.

In the world of credit card payment, the merchant carries all the risk. If a credit card holder requests a chargeback, the money is not only immediately refunded, but the merchant is also fined. According to the logic of the credit card companies, he caused damage (lost profit, reverse transaction cost). It was his responsibility to ensure that…

- the customer gets exactly what was paid for.

- he is actually doing business with the card holder and not someone who stole his wallet.

The later can/should be achieved by asking the customer for an ID document and/or asking him to sign the invoice, then comparing that signature with the signature on the back of the card. This is, of course, a relic from the old imprinter days and totally impractical for internet payment. In fact, credit cards should never have been allowed on the internet in the first place. There simply is no way for an e-commerce site to tell if they are dealing with mum or mum’s credit card wielding kid.

A chargeback can, of course, be disputed. The process is awkward to say the least and may include paperwork (take “paper” literally here) being faxed around. In a nutshell it comes down to building a case where the credit card issuer is judge, jury and executioner. The whole system is utterly rigged against the merchant, too:

- Credit card companies are highly motivated to keep their customers happy (decide in their favor).

- The merchant is screwed whether he wins or looses. He earns negative karma with the network either way.

Credit card networks don’t care whether a merchant wins or looses a dispute. Only how often disputes happen. If they happen too often, the merchant becomes a risk factor and may even be banned from accepting credit card payment altogether. Let me make this very clear: you can be the most ethical merchant in the world. If you have shitty customers that request chargebacks for the lols, your business will be driven into the ground with fines and ultimately you will be cut off from receiving payments as well: the merchant carries all the risk.

But… what’s PLATDI’s game now?

It’s actually quite a brilliant gamble. Obviously, no one will pay $200 for a toy app. Heck, most people probably wouldn’t even willingly pay $2 for it, but there is this tiny chance that someone might trip into the subscription by accident. That’s what PLATDI Studio is after. They are playing it big here: spend a massive amount of money on advertising in order to bring in as many “victims” as fast as they can (the $200 price tag is not so much outrageous, but rather a high stakes gamble). Speed is of the essence here. As many accidental payments as possible must be captured (to use credit card lingo) before outraged users can burn the app with reports and negative reviews.

If everything goes well, a few hundred people will provide credit card details in order to check the trial out, forget about cancelling and get a rough reminder when their monthly credit card statement arrives in the mail. By then, the money will already be in PLATDI’s bank account and the company vanishes into thin air. Dealing with disgruntled users, covering refunds and dispute fines(*), is left to Google. Rinse and repeat the same game next month under a new name and a new set of bought up apps.

(*) There is a big difference between a refund (asking the money back from Google) and a dispute (asking your credit card company to get the money back from Google). The later is not only really expensive and harmful to Google, but also unwarranted. Do that and Google will do what every merchant does in this case: close your account and never do business with you ever again.

English

English

Deutsch

Deutsch

Comment

Comment Subscribe

Subscribe Latest Blog Posts

Latest Blog Posts